Yes, folks, that old tried and true formula is back again. Feel the nostalgia! Carter! Nixon! Hammurabi! Price caps have a proven track record. They fail every time and wreck the economy. HWat are they thinking out there in the middle of the Pacific? Malia Zimmerman has an idea.

So why bring back price controls more than 30 years after Nixon tried them and failed miserably, causing shortages, rationing, inflation and an economic crisis? It's hard to find a reason, other than to retaliate against the big oil companies, namely Chevron, which many Democrats tried to punish unsuccessfully in court.Hmmmm... I've heard this argument somewhere before. How to explain?

Made up primarily of liberal Democrats with no economics training, no business background, an open disdain for the free market, and a lust for price caps (except on state taxes), lawmakers say they have to "do something" about the high price of gasoline. (Groan...Ed.) Never mind that oil prices have skyrocketed everywhere thanks to increasing demand in the world market and rapid growth in China and India.

Led by Rep. Hermita Morita and Sen. Ron Menor, who delivered lengthy speeches on punishing the "greedy" oil industry, the Democratic majority passed a version of the bill in 2002. Sen. Paul Whalen, much to the horror of his Republican peers, helped introduce the measure.

Brian Barbata, a jobber for Molokai and Lanai, fought against the proposed legislation, telling lawmakers they're just plain wrong about the causes of higher gas prices. "High prices in Hawaii are a myth," he says, "perpetuated by the media to the level of urban legend." Mr. Barbata believes Hawaii's sky-high gas taxes (the highest in the nation) are driving up prices. Maui County, he explains, has the highest taxes in the state at 60 cents a gallon, compared with 29 cents a gallon in Alaska. "Subtract the associated taxes and you will find Hawaii is not out of line at all," Mr. Barbata says.Hmmmm... high gasoline taxes are to blame? I've heard that argument before too.

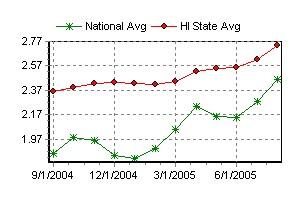

Let's see how Hawaii's gas prices compare to the Nation's.

Hmmm...I think it may be a little of both. Hawaii appears to have had higher prices for more than just a few months back. That looks like it could be a combination of higher wholesale prices and higher taxes. Yep.

Let's do the math.

As of November 2004:

National average of federal and state gasoline taxes = $.44/gal.

Hawaii average gasoline taxes = $.572/gal.

Difference = + $.132/gal

Current National average gas price: $ 2.603

Current Hawaii average gas price: $ 2.846

Difference = + $ .24.3/gal

So if it were only gasoline taxes, then gas in Hawaii should only be about 13 cents higher than on average (understanding that Hawaii prices are thrown into the national average as well, thus skewing the National average higher).

Let's check another state...mine:

As of November 2004:

National average of federal and state gasoline taxes = $.44/gal.

Virginia average gasoline taxes= $.374/gal

Difference = - $.066/gal

Current National average gas price: $ 2.603

Current Virginia average gas price : $ 2.553

Difference = - $.05/gal

Hey! Where'd that extra 1.6 cents/gal go? I'm getting ripped off by the greedy oil companies!

In reality, gas costs more in Hawaii because it all has to be imported. N'cest pas? And in fact, since last September, the price of Hawaiian gas has only gone up 50 cents a gallon, while its jumped more than 70 cents "nationally." Are you sure price controls are a good idea?

Despite dire predictions, Hawaii's Democrats are putting on a happy face. House Speaker Calvin Say recently told the Honolulu Advertiser that despite the possible rise in prices, the gas cap legislation should go forward. "We should give it a chance to see how it goes," he says.Oh, brother.

2 comments:

This post is a testament to why I never write about anything more complicated than baseball.

I applaud the work. I wanted to get something out on that story, but now I don't have to.

Post a Comment